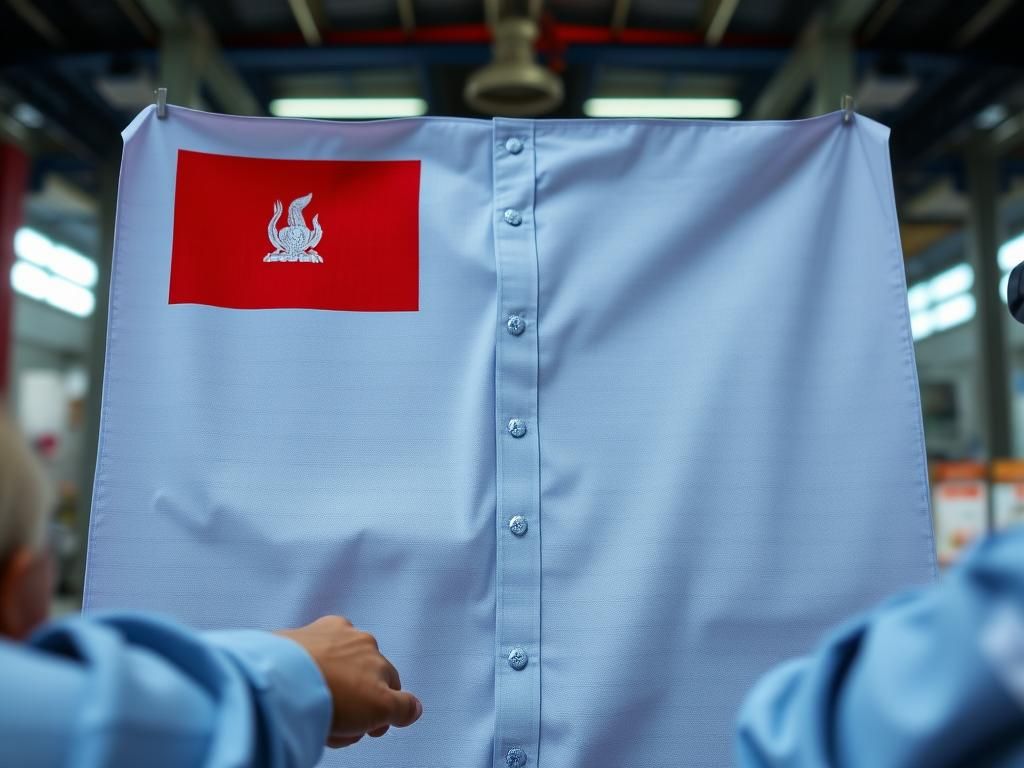

In a move that has provided a degree of relief, Cambodia has secured a significant reduction in tariffs, initially set at a crippling 49%. This adjustment, lowering the rate to 19%, staves off what could have been a devastating blow to the nation’s vital garment and footwear production sectors.

The initial imposition of a 49% tariff threatened to cripple Cambodia’s crucial garment and footwear industries, sectors that employ a significant portion of the nation’s workforce and contribute substantially to its GDP. The potential ramifications included widespread job losses and a decline in foreign investment, casting a long shadow over the country’s economic prospects.

Negotiations, details of which remain largely undisclosed, ultimately yielded a revised tariff rate of 19%. While this represents a substantial improvement over the initial proposal, concerns remain about the long-term implications for Cambodian manufacturers. The lower tariff, though beneficial, still poses challenges for businesses accustomed to more favorable trade agreements. Observers note that the reduction could lead to a readjustment in the competitiveness of Cambodian exports, potentially impacting pricing strategies and market share in key international markets.

The specific details of the negotiations and the entities involved remain shrouded in some secrecy. Public reaction within Cambodia, however, has been cautiously optimistic, with industry representatives expressing measured relief. The long-term effect will depend on global economic conditions and the ability of Cambodian businesses to adapt to the new trade environment. Moreover, the shifting geopolitical landscape adds an extra layer of complexity to the future outlook of the Cambodian garment and footwear industries.

The tariff reduction offers a reprieve, but the future of Cambodia’s crucial industries remains uncertain. Will the revised rate be enough to sustain growth and preserve jobs, or will further adjustments be required to navigate the evolving global trade landscape?